Choosing the right invoicing software as a freelancer can make your life so much easier – but there are so many options out there. That’s why I’ve compiled a list of the best free and paid invoicing tools for freelancers, so you can pick the best one for your business.

The 7 best invoicing software for freelancers are:

Below, I’ll go through each of these in more detail. I’ll provide my thoughts on who each one is best for, talk about the value each offers, and any unique features to be aware of. Hopefully this will help you streamline your freelance finances the right way!

How I Picked These Tools: I made these choices based on my own opinions on the features I deem most important for freelancers choosing an invoicing tool or app.

These include:

– Value for money

– Ease of use

– Automation capabilities

– Extra fees

While I have listed these invoicing tools in order of what I believe are the best value, I have included a note under each heading explaining who each one is best for.

The 7 Best Invoicing Software For Freelancers

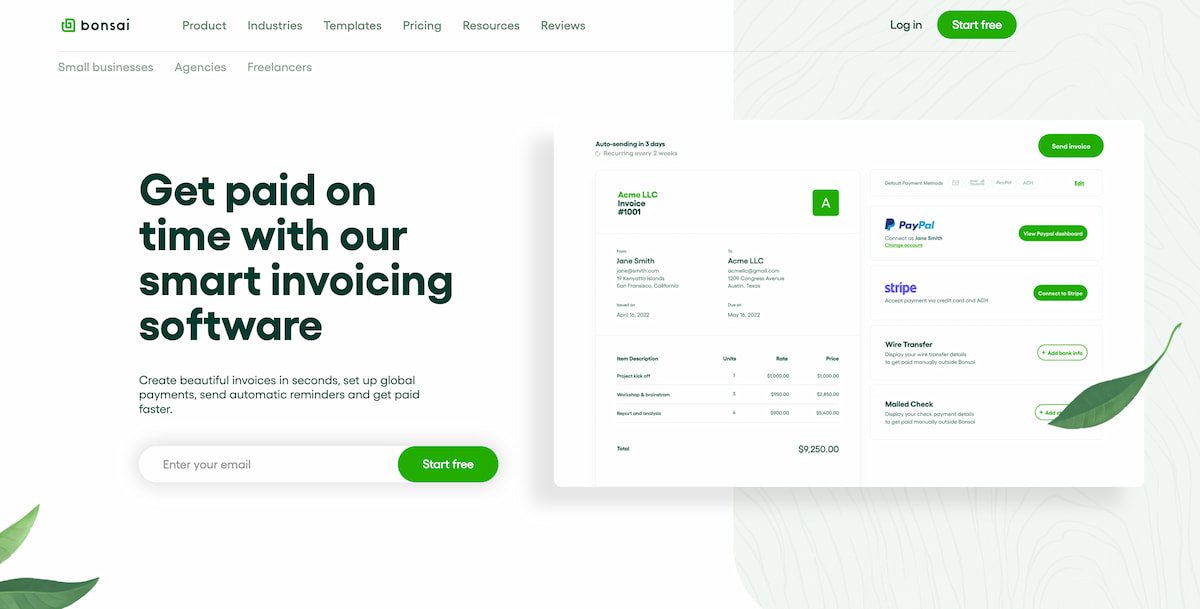

1. Bonsai

Free Option: Free invoices / 7-day free trial for other features | Best For: Freelancers looking for an all-in-one automated solution

Bonsai is an all-in-one accounting solution for freelancers. Whether you have one client or hundreds, Bonsai provides the tools you need to organize your invoices, finances, and even contracts. As this article is a list about invoicing software specifically, I won’t go too far into those other features, but here are a few of them quickly:

- Proposal and contract creation (ideal for beginner freelancers)

- Scheduling

- Time tracking

- Expense tracking

- Branded client portal (on the Professional plan)

These features make this an ideal choice for beginner freelancers, as it combines many important things into one tool. This makes managing everything to do with your clients super easy and convenient. Their Starter plan comes with most of the features you need, but freelancers with more advanced requirements might want one of the pricier plans.

How Bonsai Handles Invoicing

As for the invoicing specifically, Bonsai puts a focus on automation and streamlining. This makes it the perfect choice for freelancers that are sick of manually creating ugly invoice templates for each of their clients. Bonsai automates the invoice creation process using hundreds of prebuilt templates, and then the sending and even reminder stages too. There’s also a super convenient invoice generator.

This means you can focus on delivering high-quality work to your clients, and not have to worry about sending invoices on time. You can even apply automatic late fees when clients don’t pay on time. I’ve personally never used a feature like this as I haven’t had trouble with clients not invoicing on time, but I imagine for many freelancers this is an interesting possibility.

Other Features

You can also set up recurring and subscription billing. This makes it great for freelancers that work on large projects that perhaps require milestone payments. Or maybe you just offer a recurring service to a client and want to easily bill them on a monthly basis. This is all possible with Bonsai’s invoicing features.

Overall, Bonsai tops our list thanks to its extensive feature list, a lot of which you can access for free. If you want to get the most out of it, along with access to all

PROS:

- Free invoice creator with lots of templates available

- It’s easy to use once you get the hang of it

- Lots of other great features for freelancers

CONS:

- It might be a little overwhelming at first (there are a lot of features)

- You’ll need a paid plan for access to all features

2. FreshBooks

Free Option: 30-day free trial | Best For: Freelancers that want a simple invoice and expense tracking tool

Freshbooks is one of the most popular invoicing tools for freelancers and other small business owners – and for good reason. It comes packed with useful features for tracking your finances, and it’s easy to use as well.

Taking its wide range of features into account, FreshBooks is pretty affordable. For just $8.50/month, you can manage up to 5 clients on FreshBooks, and track and send as many invoices as you want to those clients. Their more expensive plans of course raise the number of clients as you grow your freelance business, but for beginners, the Lite plan is likely all you need to get started.

Free Invoice Generator

Freshbooks also offer a free invoice generator if that’s all you need. It’s super easy to use, you just input your information and then download it when you’re done. There are also templates available, with different styles all available for download as Excel, Word, Google Docs/Sheets, and PDF files.

There’s a 30-day free trial available, and you can use this time to test if FreshBooks serves your needs, and upgrade to a paid plan later on. If you’re looking for software to start small and scale up in the future, FreshBooks is a good option to try.

PROS:

- Great free invoice generator and templates available

- Fairly affordable

- Easy to send your invoices from the FreshBooks dashboard

CONS:

- You only get 5 clients on the cheapest plan

3. QuickBooks

Free Option: 30-day free trial | Best For: Freelancers with lots of expenses to track

Up next is QuickBooks, another comprehensive accounting solution that has options specifically for freelancers and other small business owners. There is a free trial available, but there are of course paid plans too for those that need more advanced features.

Like the others mentioned above, QuickBooks comes with a suite of features other than invoicing, and these include:

- Accounting

- Expense tracking

- Sales tax calculations

- Receipt capture

- Estimation tools

Invoicing Features

QuickBooks lets you create custom invoices, and there are options to put together recurring ones too. This is ideal for freelancers that regularly invoice the same clients. You can even set up progress-based invoices that allow you to accept payments over time based on how much of the project has been completed – handy for those working on long projects.

The recurring theme with each of these tools is that they offer a streamlined accounting solution, and QuickBooks is no different. It’s definitely one to consider if expense tracking is an important thing for you, as that’s definitely one of their plans’ key features.

PROS:

- Simple and fast invoicing solution

- Lots of other expense-related features

- Assisted bookkeeping feature (quite a pricey extra) is ideal for those that need more help

CONS:

- Plans are a little expensive

4. Invoice Ninja

Free Option: Yes | Best For: Freelancers looking for a comprehensive but free invoicing tool

Invoice Ninja is unique compared to the other options I’ve already discussed – it has a comprehensive free plan dedicated to invoicing! You get unlimited invoicing for up to 20 clients, and there are 4 templates to choose from.

Free vs Paid Plans

While the free plan will likely suit most beginner freelancers in need of a free invoicing tool, their first paid plan gives you unlimited clients. It costs around $10 per month, which I think is pretty reasonable for what you get. Perhaps a critical feature for some is the removal of the Invoice Ninja branding on your invoices – something to definitely be aware of on the free plan.

You also get access to 10 templates instead of 4 (which is possibly still a little limited in my opinion), along with recurring and auto-billing capabilities. It is a pretty dedicated invoice creation tool, while the others on this list above are more all-in-one solutions. This can make it the ideal choice for freelancers that want a simple, invoice-focused app.

PROS:

- Free invoicing for up to 20 clients

- Very focused on invoicing features

- Easy to get started

CONS:

- There aren’t that many templates available

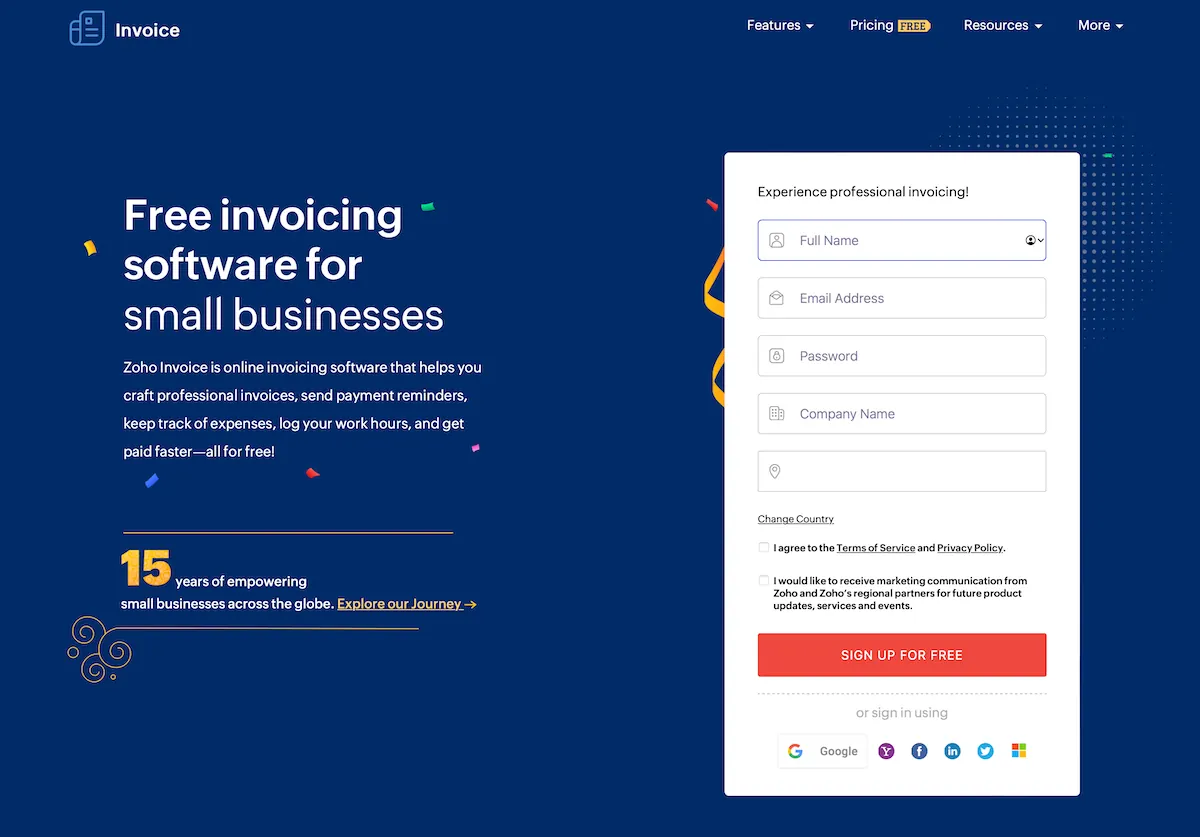

5. Zoho Invoice

Free Option: Yes | Best For: Freelancers in need of a free accounting solution with dedicated invoicing features

Zoho Invoice, part of the larger Zoho brand, provides a suite of online productivity tools. From spreadsheets to sales management systems, Zoho is a great customer relationship management (CRM) service. But the invoicing sub-service is a great tool for those that don’t want to pay for an additional invoicing app.

Automation – For Free!

Beginner freelancers can benefit from Zoho’s free invoicing plan. This is great if you’re on a tight budget, but if you do want the extra CRM features there are a few paid plans to choose from. We won’t focus on them in this article, but you can check them out here. There are also various other products on offer, but we’ll stick to the invoicing.

As you might expect from such an invoice-focused tool, you get lots of relevant features, including:

- Customizable invoice templates

- Scheduling recurring invoices

- Digital signing

But you can also provide quotes, save client information to your contacts (along with credit card info), set up payment reminders, and use lots of different payment gateways (10 to be precise). Overall, it’s the perfect choice for freelancers looking for a free solution that doesn’t compromise on key features.

PROS:

- Lots of invoicing features

- Completely free to use

- Plenty of additional features included

CONS:

- Not the best tool for freelancers that need an all-in-one accounting solution

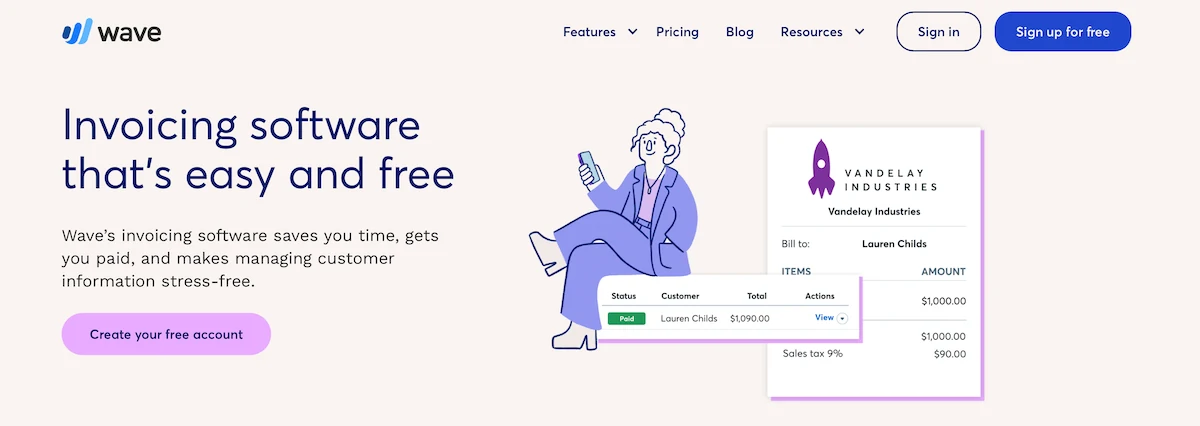

6. Wave

Free Option: Yes | Best For: Freelancers that want a free accounting solution

Wave is a cloud-based invoicing software that’s ideal for freelancers based in the US and Canada. Wave offers features including a free invoice generator, invoice scheduling, and payment and expense tracking. Wave offers all these services for free, although there are transactions fees on any direct payments made by clients, and they can vary a fair bit.

Wave is specifically designed for small businesses and is easy to use. When it comes to preparing invoices, it offers various templates you can customise. Unfortunately, it’s currently not available outside of the US or Canada. If you’re based in the UK, check out the final option on the list below!

Wave’s Invoicing Features

The free features available with Wave include:

- Customizable invoices

- Automated payment reminders

- Unlimited income and expense tracking

It’s not the most extensive accounting tool, but considering it’s free to use these features, I’m quite impressed.

PROS:

- Decent range of free features

- Invoices are easy to create and customize

- Various payment options available

CONS:

- Not an extensive accounting tool

- Only available in the US and Canada

7. Crunch

Free Option: Yes | Best For: Freelancers based in the UK

Finally, we have a UK-focused solution with Crunch. Crunch’s basic software package is free and is an ideal choice for freelancers who are just starting out or have fairly basic invoicing needs. Crunch’s basic package is comprehensive, including features like a free invoice generator, the ability to record and track expenses and payments, and auto-reminders.

Unlimited Invoicing

You can also create unlimited invoices and save unlimited expenses on the basic plan. This is ideal for any freelancers that just want a simple but comprehensive invoicing solution without spending any money. It’s also great if you’re considering an all-in-one accounting tool but want to test the waters first to see if you actually need one.

The paid plans do offer more comprehensive features, with expert accountancy support being one of the standouts. This can be something to consider for the future, when you may need extra assistance as your business expands. But for a simple, free invoicing software, Crunch is definitely one to consider for UK freelancers.

PROS:

- Great free invoicing software

- You also get expense tracking on the free plan

- Paid plans come with expert assistance

CONS:

- Only available in the UK

Can You Make Invoices For Free As A Freelancer?

You can make invoices for free as a freelancer, and there are many different ways to go about it. You can use dedicated free invoicing apps (like Crunch or Invoice Ninja discussed above), or you can use solutions like PayPal, Google Docs, or even Microsoft Excel.

What’s The Best Free Invoicing Tool For Freelancers?

The best free invoicing app for freelancers is Invoice Ninja. It’s a dedicated invoicing tool, which means while there are other accounting features available, its roots are in exactly what you’re looking for – invoicing!

You can create unlimited invoices for up to 20 clients all for free, and it’s super easy to use. If you want an alternative free option, the likes of Wave for US and Canada or Crunch for UK freelancers are definitely worth checking out.

Do You Need A Dedicated Invoicing App?

You don’t need a dedicated invoicing app as a freelancer, as many apps you may already use often provide invoicing features. I’ve mentioned the likes of PayPal above, but you can even invoice with Microsoft Word!

Sure, you can’t always send invoices through apps like these (you can with PayPal). But if you’re happy creating your own customized invoice from scratch and sending it yourself, you definitely don’t need to shell out for a dedicated invoicing tool.

Which Freelance Invoicing Tool Is Best For You?

Which freelance invoicing tool is best for you really depends on how many clients you have, how complex your projects are, and whether you have other accounting needs. Many of the tools on this list have lots of non-invoicing features that might be great later down the line, but if you just need invoicing tools, they may be unnecessary for now.

My top pick is Bonsai, due to the sheer variety of features on the platform. You get a lot of capabilities for free too, which makes it ideal for all kinds of freelancers with all kinds of needs.

Chris is the creator of Freelance Ready. He originally started freelancing (on Fiverr) while at university, writing and editing website content. He created this website to share his freelancing experience and help others on their own self-employed journeys. He is now a freelance SEO consultant and content editor. You can learn more about Chris here.

Freelance Ready is reader-supported. That means some links on this website are affiliate links. If you sign up or make a purchase through these links, we may earn a commission.