PayPal offers a handy invoicing tool that freelancers can use to get paid on time. It’s not necessarily the first choice for many, but if you use PayPal for all or some of your clients, invoicing them directly through the platform can be a simple way to get your money.

The 4 steps to create an invoice on PayPal as a freelancer are:

- Go to PayPal and select ‘Create and manage invoices’

- Select ‘Create Invoice’

- Add the necessary information to the invoice template

- Save and send the invoice to your client

You can access PayPal’s basic invoice generator without a PayPal account, although by setting up a PayPal Business account you can access other handy features, such as invoice tracking. Below, I’ll go through these steps in more detail, and discuss whether you should be using PayPal for your invoices in the first place.

Note: The steps below will vary depending on whether you have a Personal or Business PayPal account. I’ve gone through the steps for Business, but for Personal account holders, you find the Invoicing section by going to Send and Request > More > Create an invoice. The steps after that are essentially the same for both account.

4 Steps To Create A Freelance Invoice On PayPal

1. Go to PayPal And Select ‘Create and manage invoices’

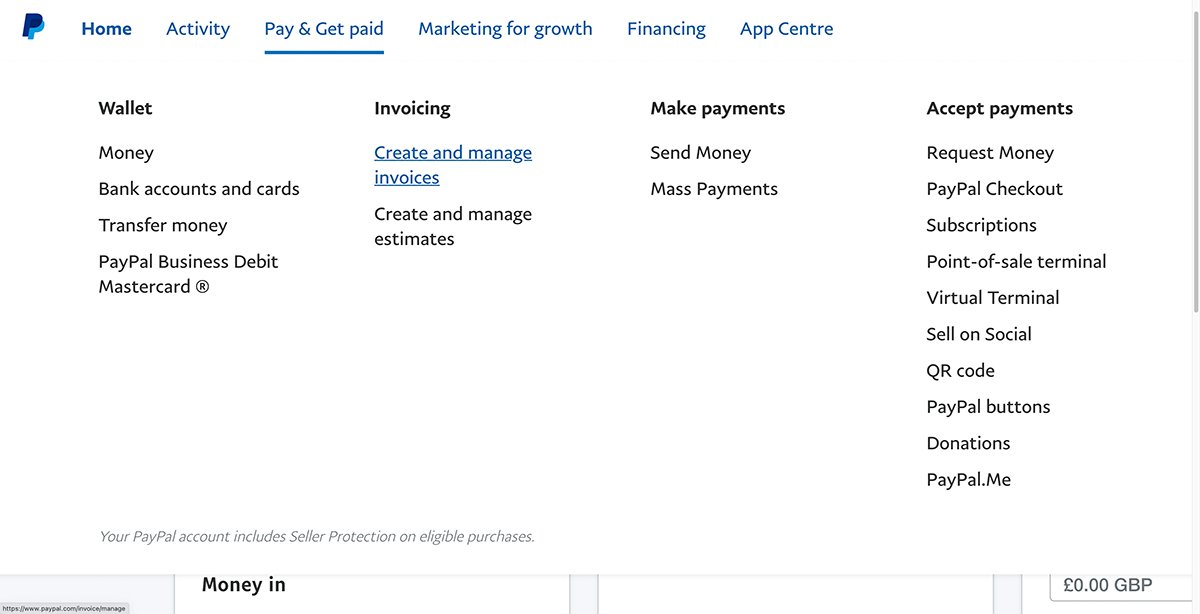

If you’re using a PayPal Business account, go to the bar at the top and then Pay & Get Paid > Invoicing > Create and manage invoices. You might also be able to access it from your account overview under the Actions section.

2. Select ‘Create Invoice’

You can either create one invoice or select the Create Batch Invoice button. The batch option allows you to add the details for various different invoices all at once. That can be useful, but for now I’ll focus on creating a single invoice.

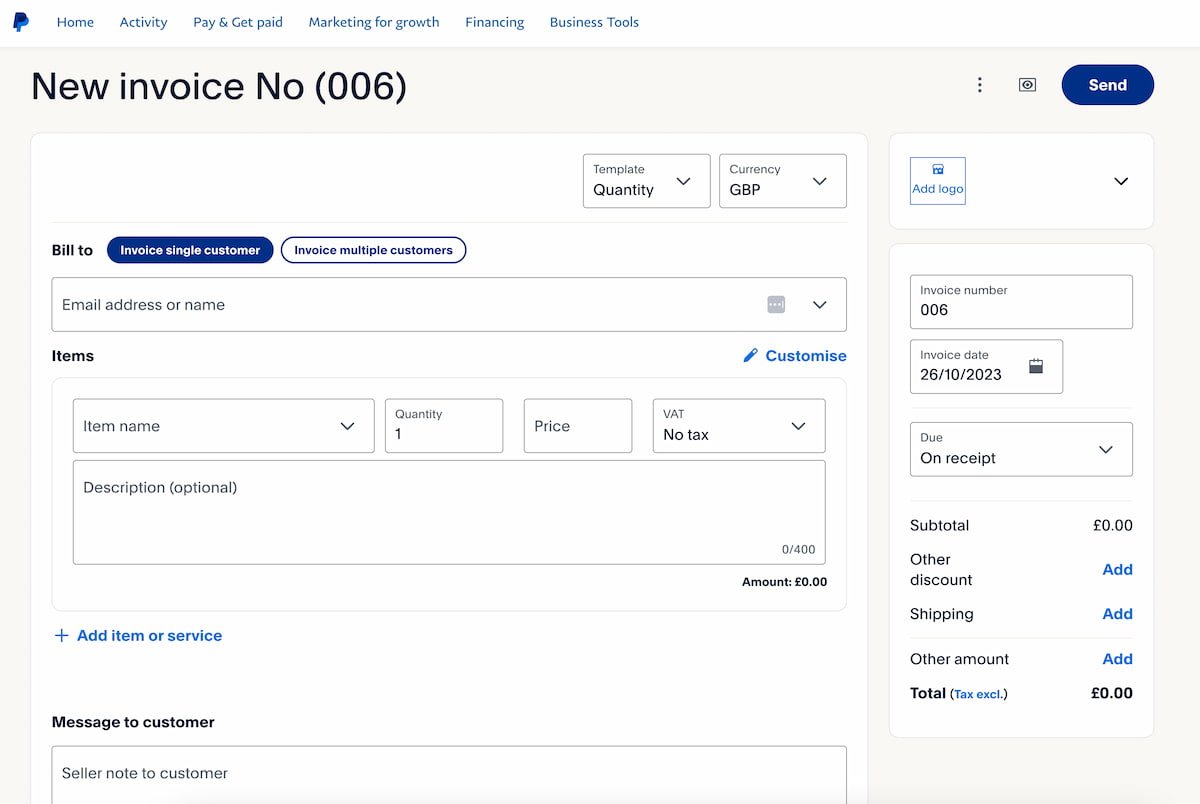

3. Add The Necessary Information To The Invoice Template

Next, go through the invoice template and add the necessary information, such as the client’s email, the item description, and pricing. By clicking on More Options, you can also add a message to your client, the terms of payment, and a unique reference number. You can also add your logo to the invoice if you have one.

I talk more about what to include on an invoice in the next section, but you can also learn more in our article all about invoicing as a freelancer.

As you add details like prices and quantities, PayPal’s invoice generator will calculate everything for you. This makes it a really easy way to create your freelance invoices.

4. Save And Send The Invoice To Your Client

Once you’re done, click the Preview button (the rectangle with the eye in the middle) to check that the information you’ve entered is correct. If you need to make any changes, click Edit Invoice.

Once you’re happy with the invoice, click Send to email it directly to your client for payment. You can also save the invoice as a PDF. This is also a good idea to keep one for your offline records. Clients can pay through PayPal if they have an account, or by using their credit or debit card.

Now let’s go through the most important things to include on your PayPal invoice.

What To Include On A PayPal Invoice

If you’re based in the UK, HMRC requires you to include certain information on an invoice. To start, the document must be clearly marked as an ‘Invoice.’

At a minimum, it needs to include:

- Your business name, address and contact details (you must also include a business name and address if applicable)

- Your client’s business name and address

- A unique identification number

- The invoice’s date of issue

- Clear description of the goods/services provided, including quantities

- Date the goods/services were provided

- Total cost of each good/service

- VAT (if applicable)

- Total amount owed

It’s also a good idea to include:

- Information as to how the invoice should be paid (bank account details or a PayPal address etc)

- A payment timeframe

- A thank you message

In the US, invoicing requirements are more relaxed, but including the above information is a good place to start. Invoicing regulations vary between states (and other countries) so it’s best to check the specific requirements with your local authority.

Next, I’ll discuss the pros and cons of invoicing on PayPal, before answering the question of whether you should use it as a freelancer.

Pros & Cons Of Invoicing On PayPal

| PROS | CONS |

|---|---|

| It’s free to create invoices | You will pay fees when accepting money through PayPal |

| It’s one of the easiest ways to generate freelance invoices | The invoice template is quite generic with limited customization |

| You can save invoice templates to use again later | Money goes to and from your PayPal account, which might not be ideal for some freelancers |

| You can email invoices directly to your clients | |

| You can also track invoices and payment statuses |

When it comes to generating invoices, PayPal is easy to use and the additional features it offers for business account holders can help you keep track of your clients’ payments. But there are a few caveats when it comes to using PayPal as invoicing software for your freelancing business.

A Closer Look

Most importantly, while PayPal doesn’t charge any additional fees to generate or track invoices, the usual transaction fees apply to any online payments your clients make. This can add up over time, as PayPal takes a chunk of your potential earnings. Most platforms and banks charge fees, but PayPal’s can be quite egregious.

The other obvious thing to be aware of is that this is only a practical solution if your clients want to use PayPal to pay you. The invoices go to them directly, and you get paid into your PayPal account. You can then withdraw your money as needed, but this clearly won’t be the optimal solution for a lot of freelancers.

They can pay with other methods, but if your clients don’t request you use PayPal for payments and you have other options, I’d strongly consider them to avoid paying excessive fees.

But it is super easy to generate freelance invoices with PayPal. The template is straightforward and it does most of the work for you. So if you want a simple solution and don’t want to use other invoicing software, it could be the perfect way to send invoices. It’s great for beginner freelancers for this reason, and if you get a free business account you can also track your invoices and keep track of payments with ease.

Should You Use PayPal For Freelance Invoices?

I imagine the main reason many freelancers consider using PayPal for their invoicing is because that’s how their clients prefer to pay them. This is definitely common in the freelance writing industry in particular.

PayPal offers a very convenient and popular way to conduct payments. So it’s no wonder many freelancers use it. I’ve used it plenty of times in the past, and for the most part it’s a good experience. But as I’ll outline below, there are definitely platforms that do it better.

Are PayPal Invoices Free?

PayPal invoices are free. It’s free to set up a PayPal account, and straight away you’re able to send invoices to your clients, completely free of charge. The usual fees still apply for sending and receiving money on PayPal, where applicable.

This means you’ll need to deal with PayPal’s typical fees if you accept payment through the platform. But this is true whether you use the invoicing feature or not. You’re likely used to these fees, and only using PayPal invoices because that’s how your clients want to pay you.

That’s fine, but you should be aware that PayPal’s fees are pretty hefty compared to some competitors. Especially if you’re getting paid in multiple currencies or need to perform exchanges. That’s where I’d recommend Wise instead. They have handy invoicing features too, and you can learn more in my guide to Wise for freelancers.

Kate is an Australian freelance writer now based in Europe. She has contributed to Freelance Ready as both a writer and an editor, drawing on her legal background to write about the regulatory and financial aspects of freelancing. She’s also an expert at finding the best flat white within a 5km radius! Learn more about Kate here.

Freelance Ready is reader-supported. That means some links on this website are affiliate links. If you sign up or make a purchase through these links, we may earn a commission.